How to manage Slippage?

How to manage Slippage for Trading and Adding Liquidity on Hubble Exchange?

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. When market orders are used, these orders buy or sell at the price offered by the market thus lowering/rising the price as a result. To reduce slippage for traders Hubble uses a model (Curve invariant) that concentrates liquidity around the market price.

All traders should be aware of slippage and carefully pay attention to the impact their trade will have on the market. You can select the maximum allowed slippage for your trades.

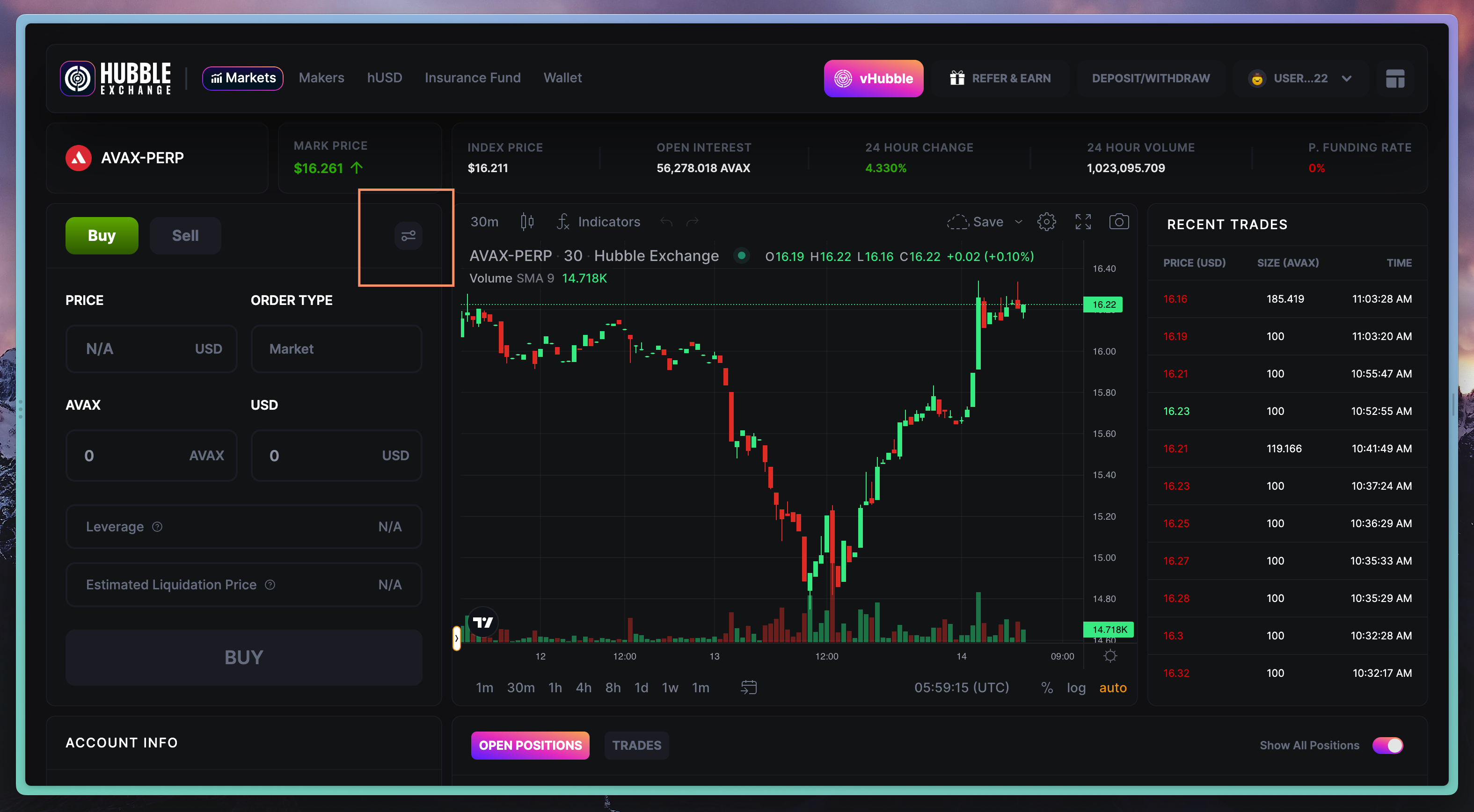

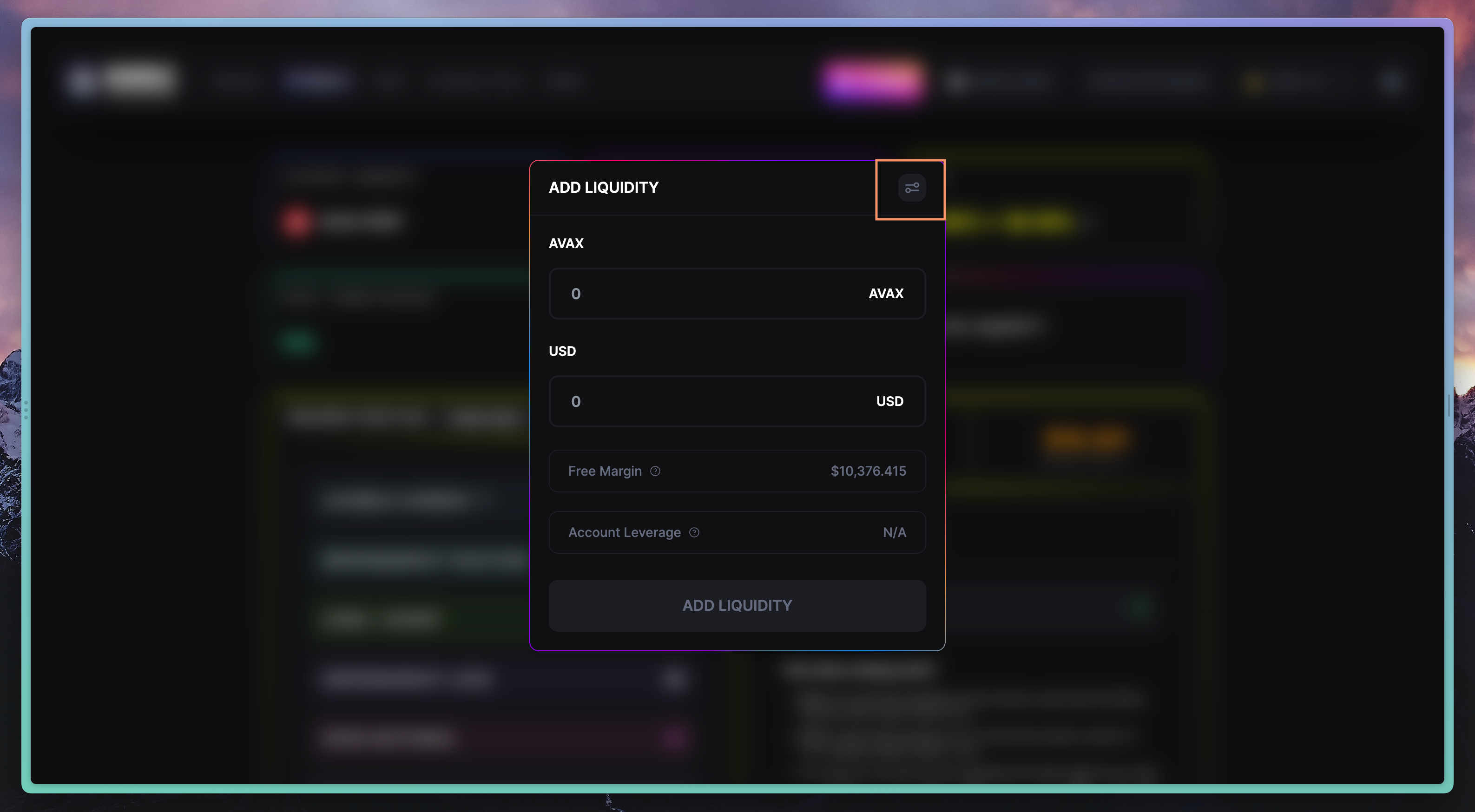

- Click on the Preference Icon on the top right corder of the buy/sell box while trading and on add liquidity modal while providing liquidity

- In Buy/Sell box

- In Add Liquidity

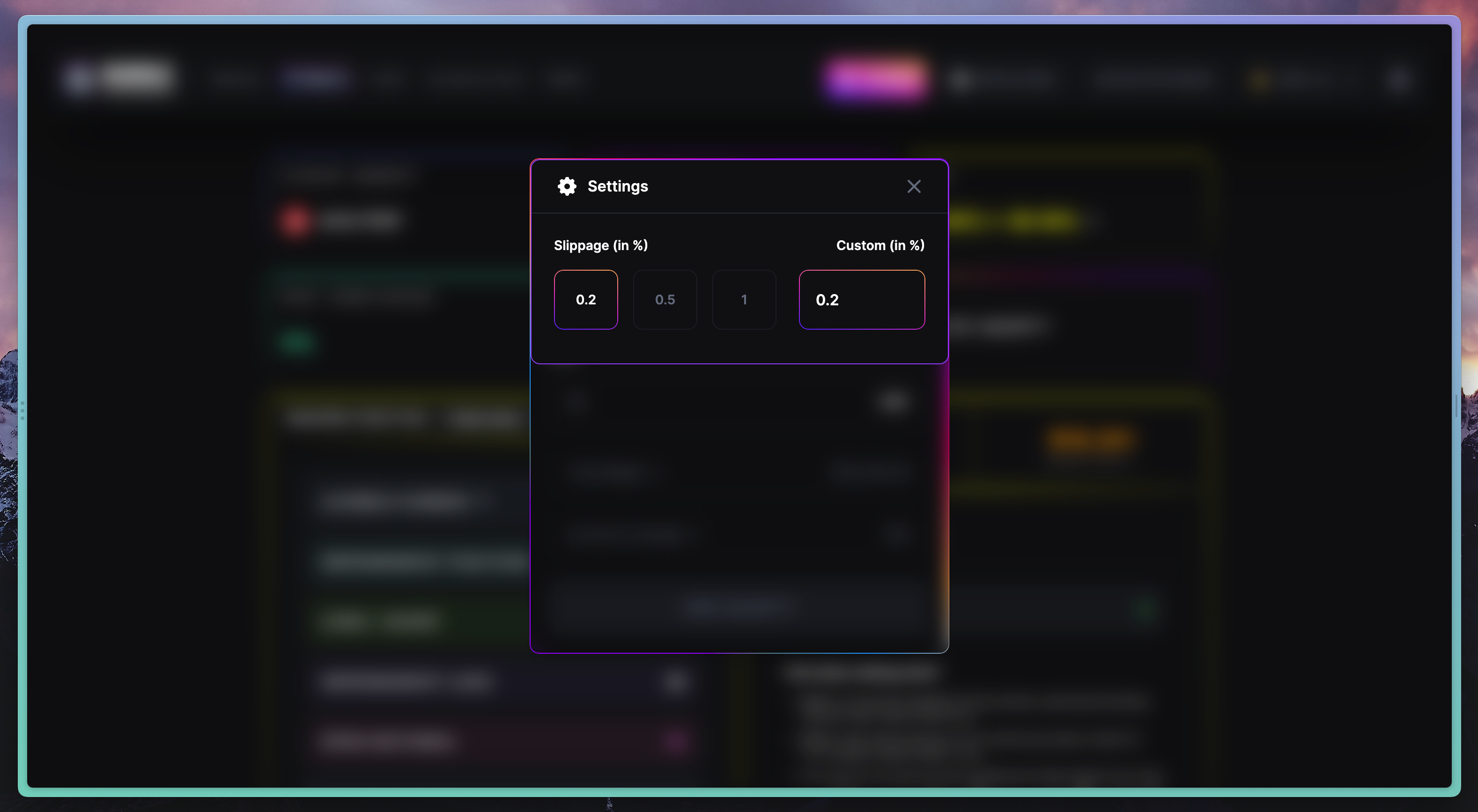

- You will see the slippage tolerance options. You can select from three options or type custom in fourth Input Box to set the maximum percentage change you are willing to tolerate between the market price when you send the order and the price of execution.

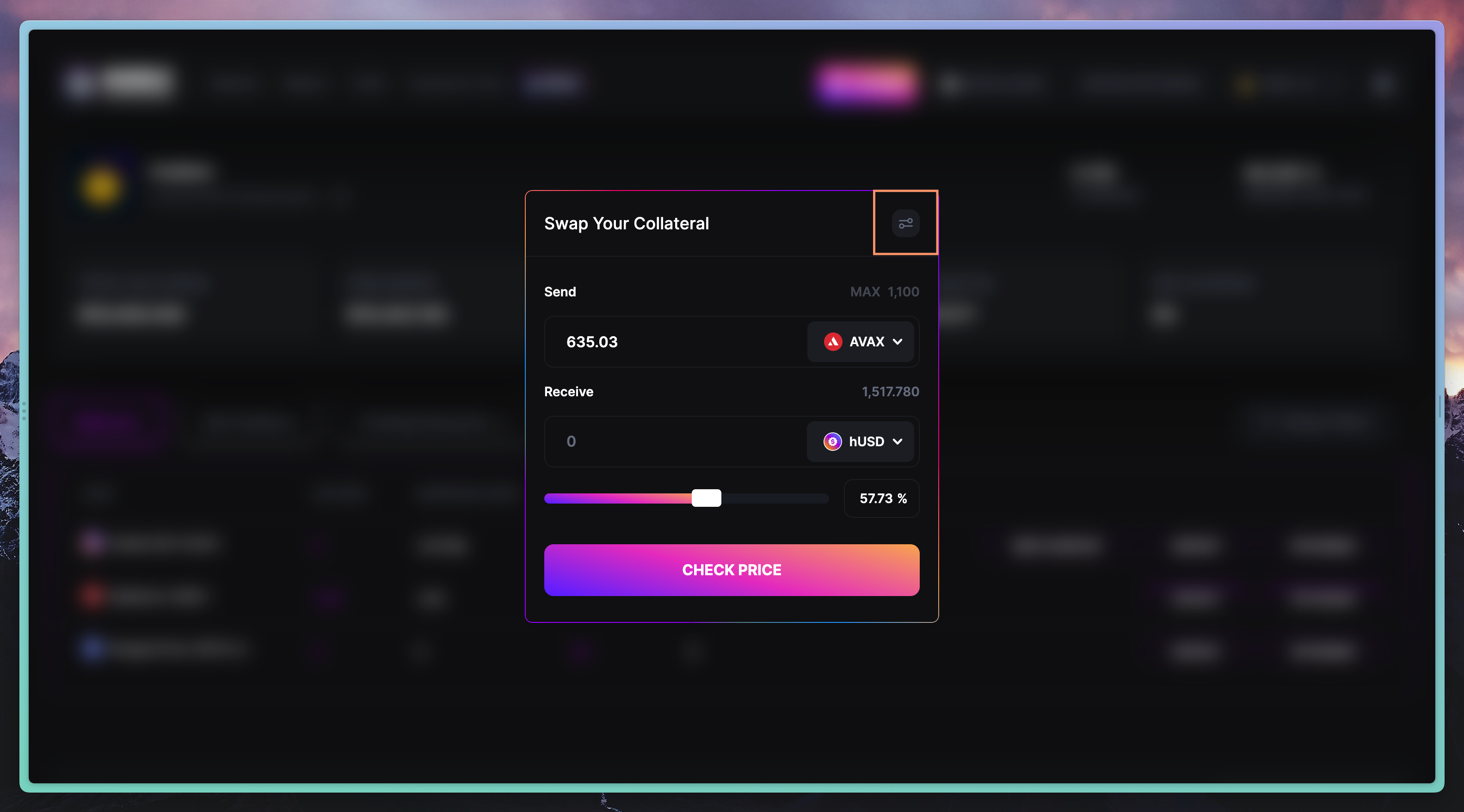

How to manage Slippage for Swapping Tokens on Hubble Exchange?

The slippage setting for swapping collateral/token is similar to Add Liquidity modal. Click on Preferences Icon on the Swap Your Collateral modal. Read More on Swap Collateral