How to Provide a Liquidity in Hubble Exchange?

Hubble is a vAMM, it uses a model like UniSwap or Curve but instead of using real tokens it uses virtualized tokens (derivatives that follow the price of the underlying asset). For every position opened by a trader in Hubble, there is a counter position opened for all makers and they share it in the ratio of their liquidity. Since the makers are being traded against, most often (but not always) makers will end up taking the unpopular position and hence be paid funding payments. Passive incoooome.

Your gain is the trading fee + funding payments + liquidity mining rewards (if any).

A difference between providing liquidity in Hubble as opposed to AMMs is that unlike traditional LP tokens, within Hubble, contracts are not backed by the underlying assets but by the deposited collateral (Margin Balance). You can provide liquidity on leverage i.e. you can add more virtual liquidity than your margin and earn fees on leveraged liquidity. A consequence of this is liquidations are possible.

How to add Liquidity to Hubble Exchange?

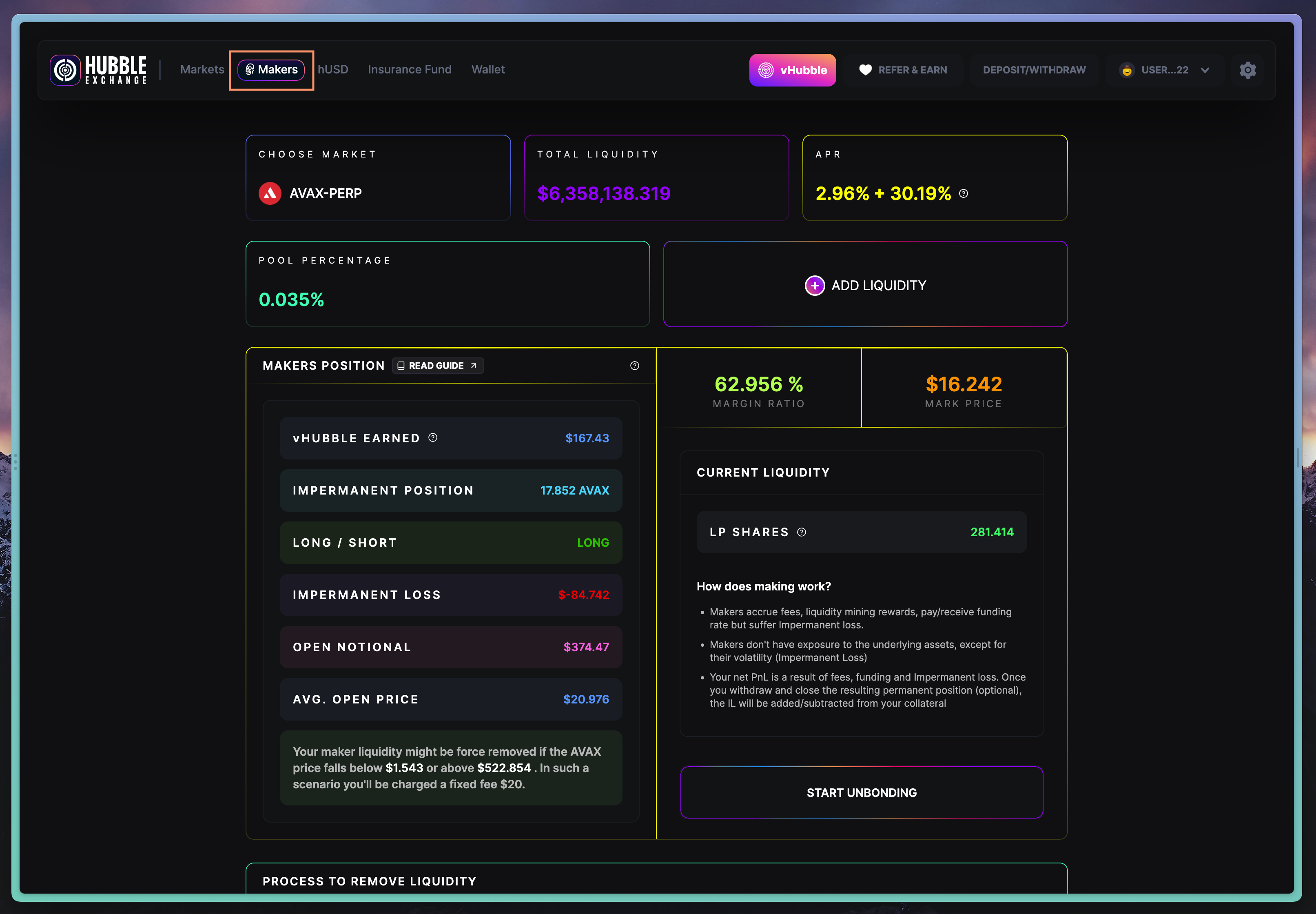

- Visit Makers page on the DApp

- Page will look like above screenshot. From the Top left you can Choose Market you want to add Liquidity to and click on + ADD LIQUIDITY button

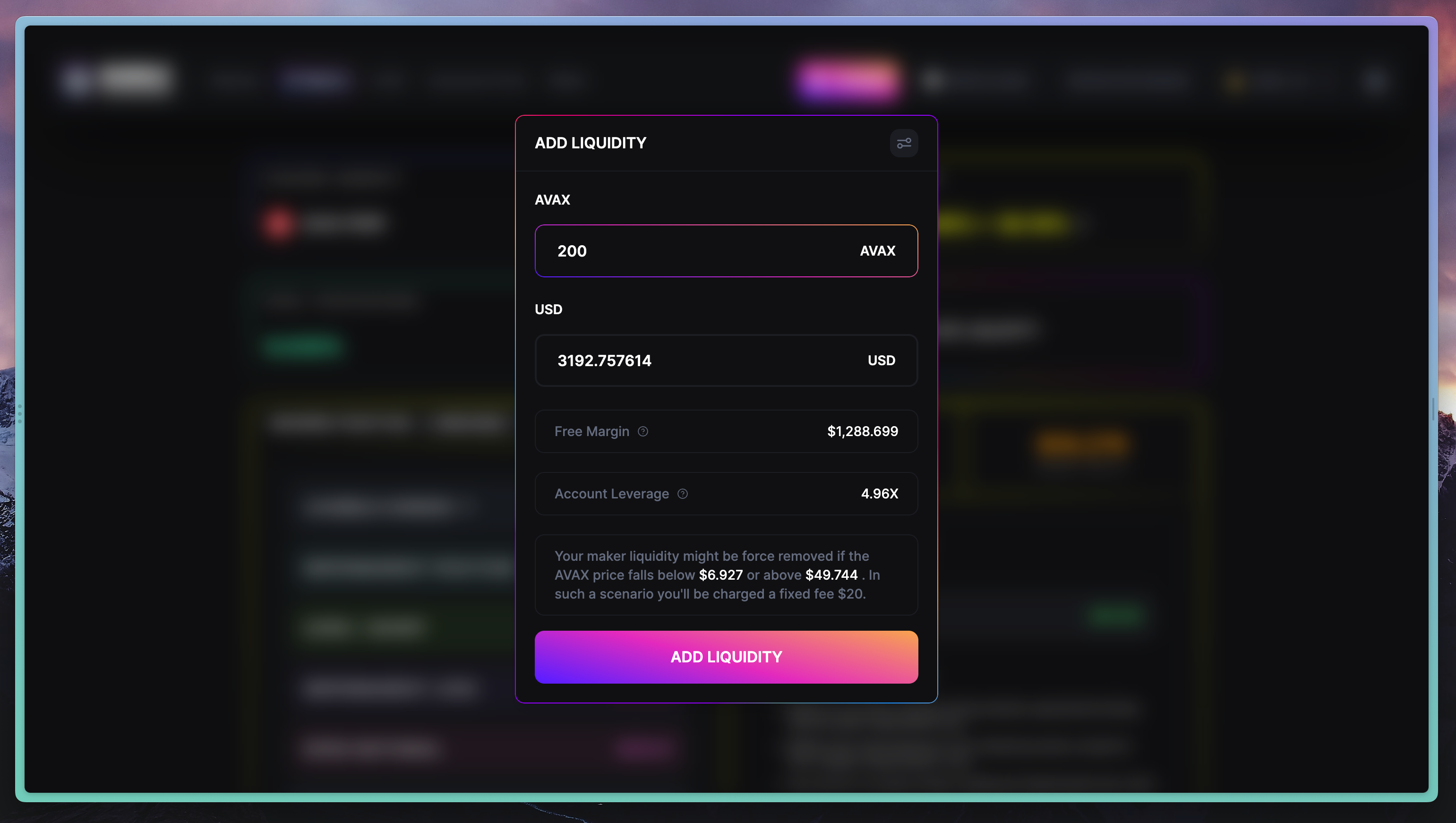

- It will open below view. Enter amount in Token in first Input box here its 200 AVAX or enter USD value in second Input box here its 3192.757614 USD

- Click on ADD LIQUIDITY button. Confirm your transaction in wallet. Once transaction succeeds, you will see the updated information of your new LP: LP SHARES and Pool Percentage on the Makers page along side wether Makers are Long or Short at the moment, PnL

How to Remove Liquidity from Hubble Exchange?

- Visit Makers page on the DApp

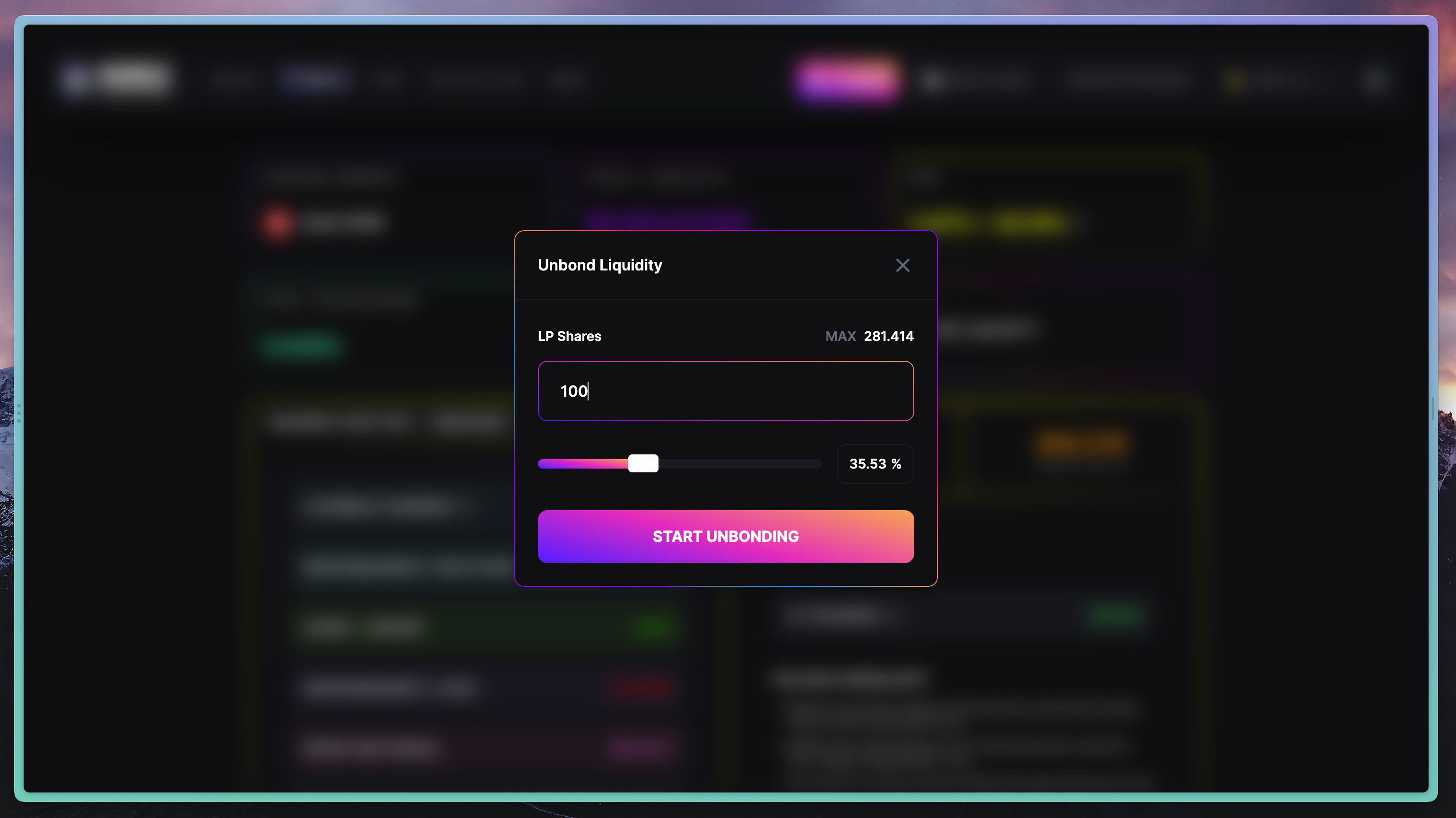

- Click on START UNBONDING button. It will open below view. Now fill the amount by using MAX button, typing manually in Input box or use the slider to adjust percentage.

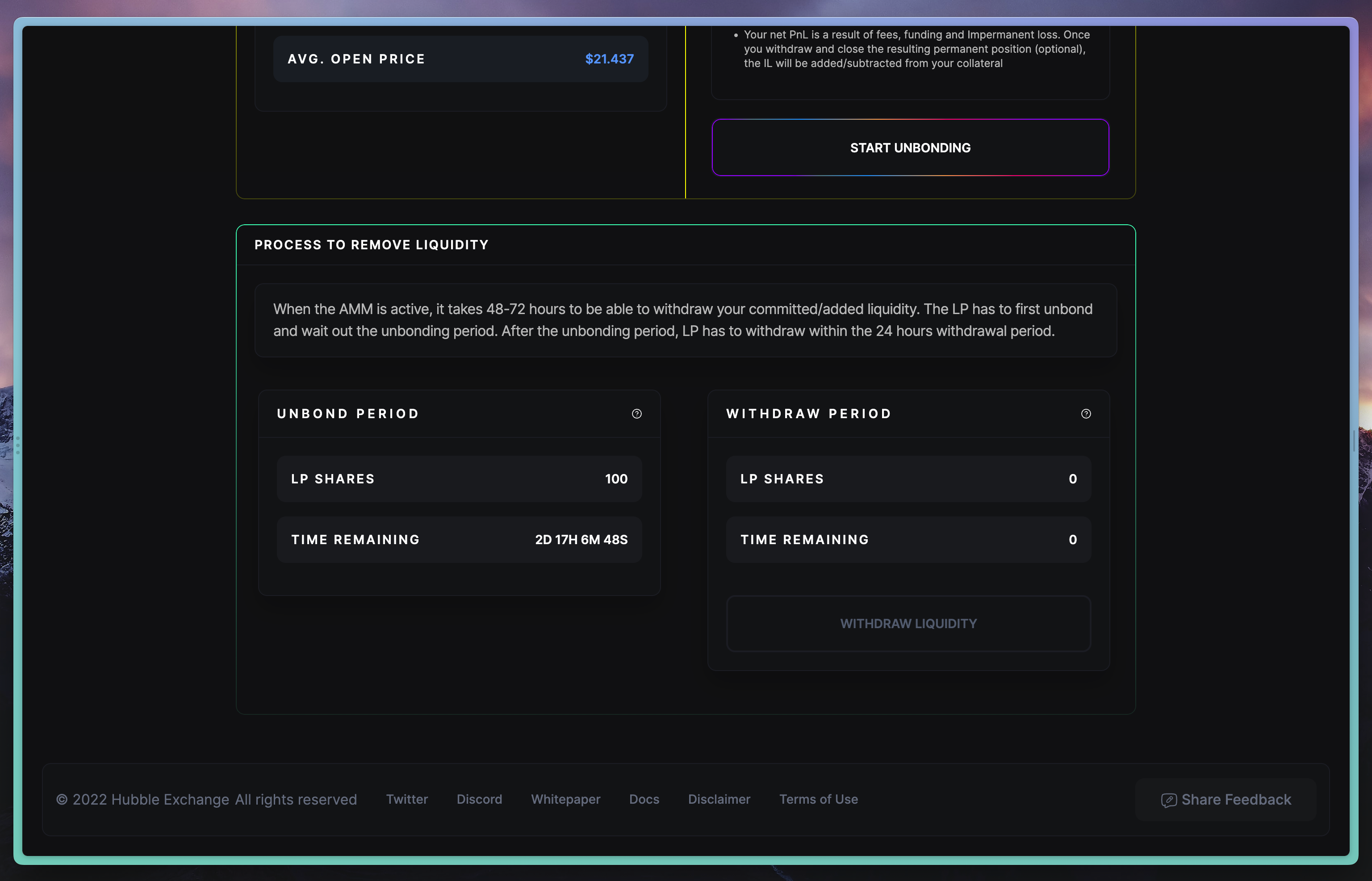

- Click on the START UNBONDING button. Confirm your transaction in wallet. Once transaction succeeds you will see below view on makers page.Note: The unbonding process will take 48/72 hours in which your position will continue to accrue fees. The Maker has to first unbond and wait out the unbonding period. After the unbonding period ends, the Maker has to withdraw within 24 hours. When withdraw period starts the Withdraw Liquidity button will be enabled; click on it and you will have the view similar to above Step 2

What are Maker Mental Models?

Say you want to LP $100 in Hubble:

- Bullish AVAX strategy - Buy a $100 worth of AVAX and use that as collateral.

- Neutral about AVAX - Use $100 hUSD as collateral

- Exact payoff as AVAX-USD TraderJoe pair (also AVAX bullish but less than 1) - Add $50 in hUSD and $50 in AVAX

- Bearish AVAX strategy - Borrow $60 AVAX on $100 USDC on any lending protocol. Sell AVAX and use $60 hUSD as collateral